This post details the analysis we carried out to estimate the revenues generated by the Korindo Group from harvesting timber as it cleared Papuan rainforest for plantations. The analysis is cited in an article we published based on a year-long investigation into Korindo’s finances and operations in Papua.

Forestry experts' calculations

A panel of forestry experts calculated that Korindo had deprived indigenous Papuans of $300 million by underpaying for timber harvested from their lands

In December 2017, an independent panel of three forestry experts convened by the Forest Stewardship Council (FSC), the main global group for certifying sustainable wood, travelled to Papua, Indonesia, to investigate allegations made against Korindo.

The FSC had certified two sawmills, a pulpwood plantation concession and a paper manufacturing plant belonging to Korindo. In 2017, Korindo was the subject of a complaint to the FSC by the NGO Mighty Earth, which alleged the group had violated the FSC’s principles by clearing large areas of Papuan rainforest and violating the rights of indigenous peoples there as it established oil palm plantations.

Among its findings, the panel estimated that Korindo had deprived local communities in Papua of $300 million by failing to pay commercial rates for the timber harvested from their lands. In its report to the FSC, the panel wrote that Korindo had made “large profits” because it had paid the Papuans as little as $0.80 for each cubic meter (m3) of timber, which the panel estimated to have an average commercial value of $250 per m3.

Reasoning that Korindo and the government bore equal responsibility for the unfair rates the communities got for their timber, and taking into account the nearly $5 million it said Korindo had spent on social programs in Papua, the panel recommended to the FSC that Korindo should pay the communities $145 million “to compensate for the damages caused to the communities due to underpayment of timber.”

The panel’s full report was never made public. Only a redacted selection of the findings were published in a series of documents. The FSC said it was not able to publish the full report “due to a disagreement with Korindo”. The published findings did not mention the $300 million estimate or the recommendation for $145 million in compensation.

The FSC opted not to expel Korindo from its scheme, instead imposing what it described as “strong measures” to ensure the firm complied with its principles in the future. During the course of our investigation, we reviewed the original report without redactions.

Korindo labels the $300 million figure “pure fantasy”

In an interview with our reporting team on April 16, Kwangyul Peck, Korindo’s chief sustainability officer, described the $300 million figure as “pure fantasy” and “downright deception”. He said the group had lost money on the logging operations that took place as Korindo prepared the land to plant with oil palms. He said the panel had erred by applying what he described as the “global price” for timber, when Korindo could only sell the timber “within the region”. In a subsequent email on April 22, he wrote that the panel had “applied the world price for the sales of timber, but it is illegal to sell timber from the plantation land outside of Papua”.

Peck provided what he described as an audit by Deloitte, one of the Big Four accounting firms, that he said provided “proof Korindo did not make $300 million from the sales of timber”. The document showed the sales of timber made by three Korindo subsidiaries that run its oil palm concessions in Papua and the costs they incurred. It showed they made a loss on harvesting and selling timber almost every year.

Local or global price?

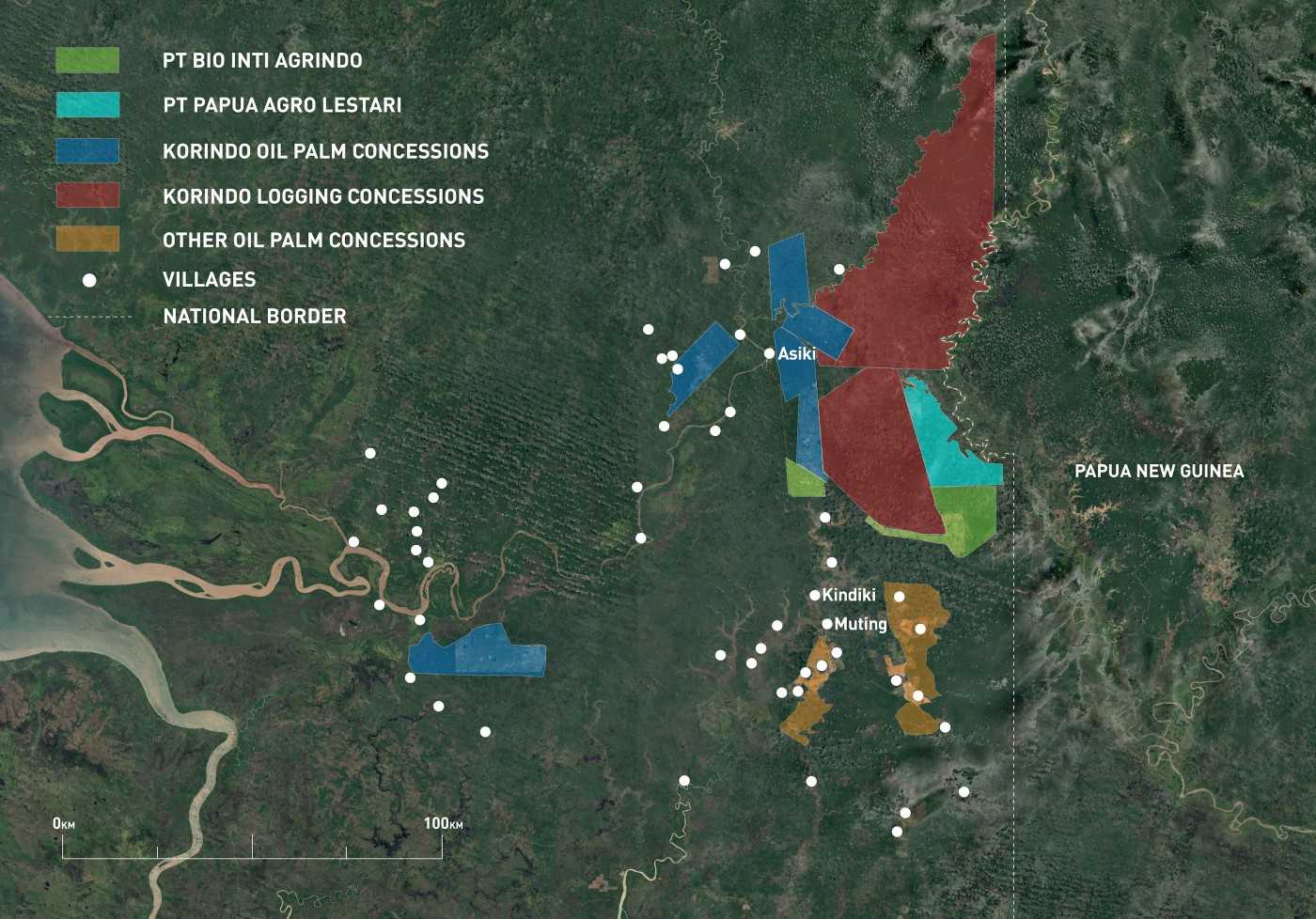

Korindo’s plantation companies in Papua sell their timber to Korindo’s own sawmill in the village of Asiki, in southern Papua. This factory, run by a Korindo unit called PT Korindo Abadi Asiki, converts the timber into plywood, and ships it to the global market. A promotional video published by Korindo in 2016 stated that the mill “exports all of its production to the Middle East” and had an annual sales target of $100 million.

As such, the Korindo Group does access global prices for the timber products derived from its plantation concessions in Papua. The profits and losses of the oil palm companies that supply its mill in Asiki, provided by Peck, reflect only one part of the conglomerate’s timber supply chain. They show sales to an affiliated party, not the revenues the group as a whole earns by placing timber products on the market. It is therefore more pertinent to assess Korindo’s revenues based on the price it obtains for the plywood sold to global markets.

Estimating Korindo’s revenues from conversion timber

We set out to establish our own assessment of Korindo’s revenues from “conversion timber,” which comes from the clear-cutting of forests. In its calculation, the FSC panel used prices for unprocessed, or “roundwood,” logs. However, as Korindo first places the timber on a competitive market in the form of plywood, we opted to assess the revenues it would generate from selling that product.

We used data from Korindo (both supplied directly to us and to the FSC panel), the Indonesian government, and satellite analysis carried out by the NGO Aidenvironment, published in its 2016 “Burning Paradise” report. We put further questions to Korindo during this process, and incorporated their responses into our analysis.

Our analysis looked at four factors:

- The area of forest cleared by Korindo’s plantation subsidiaries in Papua;

- The estimated yield of timber from that area;

- The rate at which that timber was converted to plywood;

- The price of the plywood when it was placed on the market.

1. How much forest has Korindo cleared?

Korindo supplied data to the FSC panel showing how much land it had cleared in each of its plantation concessions. These figures corresponded with the area of forest cleared in the same concessions estimated in Aidenvironment’s report. Korindo has not disputed these figures. The figures provided to the FSC show the group cleared 48,902 hectares in Papua between 1998 and 2017, when the group implemented a freeze on further forest clearing across its palm oil subsidiaries.

2. How much timber was harvested from that area?

The FSC panel estimated that each hectare of forest cleared produced 40.3 m3 of timber. Korindo disputes this figure as too high, on the grounds that the forest in its concessions had already been “logged by other companies for many years.” Korindo told us the actual yield was 16.7 m3 per hectare in the clearance that took place between 2010 and 2017, less than half the figure used by the FSC panel. (Korindo said earlier figures were “difficult to confirm” and therefore could not be provided.)

We reviewed the 2016 wood consumption report (known as an RPBBI) submitted by Korindo’s Asiki mill to the Indonesian government, a 2015 study by the nation’s anti-corruption agency, the KPK, and inventory data from the Indonesian Ministry of Environment and Forestry’s annual statistics book for 2016. Based on these sources, we concluded that the productivity rate used by FSC was already a conservative estimate.

The ministry estimated logging potential in Papua’s secondary forests of 124.4 m3 per hectare for trees with a diameter of 20 cm and over, and 68.1 m3 per hectare for trees with a diameter of 50 cm and over. The 2015 KPK report estimated average commercial timber yields in Papua, when forest is cleared, of 43.5 m3 per hectare from trees above a diameter of 30 cm.

Comparing the 2016 wood consumption report for Korindo’s Asiki mill with the land clearing data provided to the FSC, we found that in that year, Korindo harvested 48 m3 from each hectare of land its plantation companies cleared. (The wood consumption report includes a reference to timber produced by a third Korindo plantation company, but there are no records for land clearing by that company in 2016, so we have excluded it from our calculations).

While some of the area converted by Korindo in this period likely had been degraded by logging, as Korindo claims, there is evidence to suggest that much of it had not. In its “Burning Paradise” report, Aidenvironment estimated that, based on satellite imagery and maps from the forestry ministry, “most” of the area cleared by Korindo’s plantation companies before 2010 was primary forest. Between 2013 and 2016, when clearing accelerated again, 47% of the forest cleared was primary forest, according to Aidenvironment.

We also note that, according to the FSC panel, the figure of 40 m3 was corroborated by Korindo’s staff at its office in Asiki, Papua, in December 2017. As such, we used what seems a conservative figure of 40 m3 per hectare in our calculation.

3. What is the rate of conversion to plywood?

The 2016 wood consumption report for the Asiki mill shows that for every 2.2 m3 of roundwood that went into the mill, it produced 1 m3 of plywood. In our initial calculation, we used the more conservative conversion rate of 2.4 m3 to reflect two things. Firstly, mills often upgrade technology over time to become more efficient, so the Asiki mill may have been less efficient during the earlier part of the period we’re considering. Secondly, the timber being valued is from clear-cutting the forest, which can be less efficient to process as it yields a greater variation in species and diameter size than selective logging, in which only commercially valuable tree species are harvested.

Even so, Korindo disputed this conversion rate as too efficient, on the grounds that its mill was not intended to process the small-diameter timber it had harvested from its plantation lands. Korindo said that between 2010 and 2017, the actual conversion rate was 2.85 m3. To err on the side of caution, we applied this conversion rate in our final analysis.

4. What was the price of plywood when placed on the market?

Korindo told us it exported plywood at prices ranging from $400 and $650 per m3, which comports with records we obtained for exports of plywood from Bade Port in Papua, from which Korindo exports its products. In our final estimate, we used the average export price of $525 per cubic meter of plywood given to us by the conglomerate.

Conclusion

In summary, we used Korindo’s own figures for the area of forest cleared, the conversion rate, and the plywood price, disputing only its assertion about the timber yields from the area cleared. Based on this methodology, we estimated that the timber harvested by Korindo’s oil palm plantation companies in Papua between 2000 and 2017 produced plywood worth $319.9 million. Taken back to 1998, the year Korindo’s first plantation company began clearing forest, the timber harvested from the plantation lands produced plywood worth $360.3 million. We believe this is a conservative estimate, on the grounds that the actual yield may be higher given the preponderance of primary forest in Korindo’s concessions, and the conversion rate we applied.

In its correspondence with us, Korindo estimated that between 2010 and 2017, based on the lower yield figure, its Asiki mill produced plywood worth $141 million. But it said that “considering the high cost of production, labors, logistics and Corporate Social Contribution, among others,” any claim that it had made “huge profits” from logging the forest in its oil palm concessions was “not realistic.”

Our estimate represents revenue, not profit, and as such does not take into account Korindo’s processing, administrative, marketing, and logistics costs. However, it does provide context for the compensation paid to Papuan communities for the trees on their lands. If they were compensated at the rate of 12,500 rupiah (approximately $1 over the relevant period) reported to us and to the FSC panel, they would have been paid a maximum of $1.74 million, across all of Korindo’s oil palm concessions in southern Papua, since 2000. We asked Korindo how much it had paid to Papuans for timber overall, but it declined to answer.